Investment is often conceived as buying an asset that generates income or appreciates in value, without the need to do anything. This simplification makes many investors lose sight of what they are actually doing with their money.

Trust management: how to invest and not waste time and effort

If an investment pays interest or dividends, it is because someone is doing useful work for others. Let’s not forget that behind the stock indices, investment funds, bonds, and shares there are companies. These are not machines programmed to make banknotes, but organizations that do useful work for others: your customers. And they charge for it. The income they receive is used to pay all those who participate: salaries to employees, invoices to suppliers, interest to creditors, taxes to the Treasury, and, finally, dividends to capital.

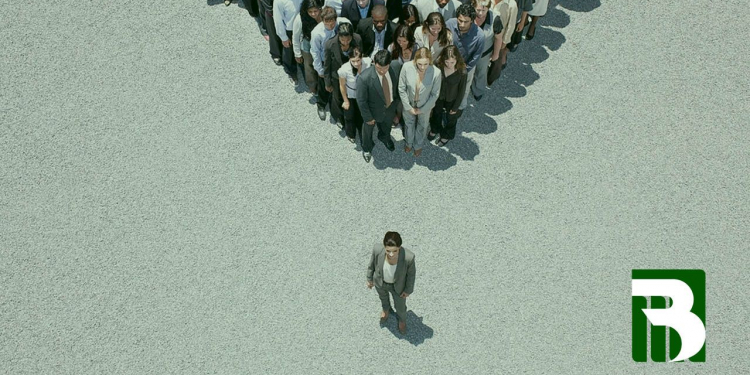

If this were not so, the company in which we invest would not be able to pay us and we would lose our investment. In other words, when we invest we are trusting in the work of one or more people and there must be reasons to trust. We are risking our capital in exchange for having the right to participate in the fruit of an activity that someone directs and that normally requires the time and work of many other people.

There must be objective reasons why we can trust some people and not others.

In every investment, there is a chain of work and trust placed in other people that we must understand. For example, when you invest in an investment fund, you trust the work of the person who selects the investments, he trusts the work of the top managers of the companies in which he decides to invest, and the top managers trust the top managers. And in the most relevant suppliers; front-line managers, in turn, trust the work of those who report to them and the vendors they hire, and so on.

In this chain of work (and investment), trust in other people cannot, and should not, be blind. There must be objective reasons why we can trust some people and not others: we want to know their training, experience, to what extent their interests are aligned with ours, how much they charge us for their work, what is the result of their previous work, how you think, how you plan to carry out your work, business model, competitive advantages, differential value proposition to your customers, etc.

Then, over time, the results will come. If these are positive, dividends will arrive, revaluations that grow with a compound interest rate, etc. If the long-term results are not as expected, it may have been bad luck, but it is also possible that we have not selected the right person. It will be time for comparisons, and we will be able to judge the performance of the people we have trusted.

Behind every investment, there is a lot of work. Every investor must monitor his investments and rethink repeatedly if he is trusting the right person or people. Thinking that all investments are similar, that profitability is generated by itself, and spending little effort deciding whom to trust, is the easiest way for our money to travel little by little to the pockets of others.